Sequin Blog

Credit

Credit Card Rejection Letters: Demystified

November 6, 2023

We’ve been there: the dreaded credit rejection letter. In fact, Sequin started because our founder, Vrinda Gupta, received a credit card rejection letter from the credit card on a platform she built while at Visa.

Of course, a best case scenario is that you avoid a rejection letter all together. The best way to do this is to do your research ahead of time: before applying for a new line of credit, model out how doing so may impact your credit score. Check your credit free with Sequin's credit score tool! and consider using our matchmaking quiz to help determine what types of credit cards you might be eligible for.

In the event that you do get a credit card rejection letter, don’t fret! Each letter contains insights we all can use to better our credit journey. Below, we will unpack three rejection letters, what they mean, and advice for what to do next.

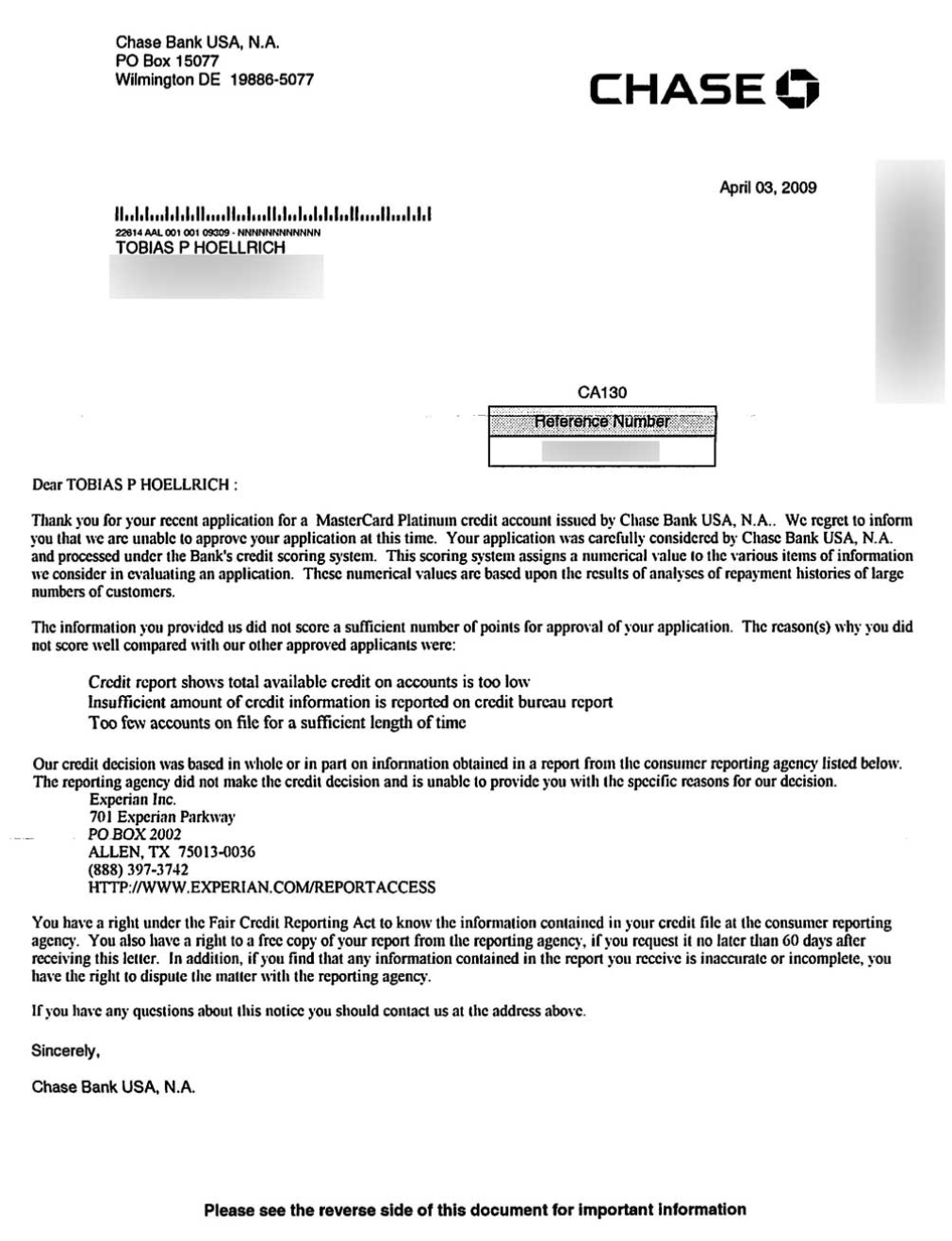

Letter #1: Not Enough Credit Built in Own Name

What it says: “Credit report shows total available credit on accounts is too low”, “Insufficient amount of credit information is reported on credit bureau report”, “Too few accounts on file for a sufficient length of time”

What it means: In this rejection notice, Chase is saying that they went to the credit bureau Experian, pulled your credit history, and found that there was not enough credit history to apply for this credit card. There are both too few credit accounts and the accounts that are open haven’t been used for long enough. When credit card issuers like Chase are trying to determine whether or not they want to extend credit to an applicant, they look for how credit worthy you’ve been in the past. In this case, there was not enough data to demonstrate creditworthiness.

What you can do:

• Stop being an authorized user, and start getting a credit card in your own name. A 2010 study by the Federal Reserve showed that married women are 2x as likely to be authorized users than married men. We’ve talked to countless women who find out too late, after being an authorized user for years, that they have not built up a sufficient credit history. If you are currently an authorized user on a card and have no other credit cards in your own name, we recommend beginning to build credit in your own name as soon as possible (see the next tip for how!).

• Use a secured card if needed in order to build credit history. A secure card is one in which you put down cash to back your own credit line, rather than being extended credit by a bank. Over time, you build up your credit history by demonstrating strong credit habits. A secured card both increases the number of accounts open and the length of time building credit, which will give useful data that helps the issuer assess their risk the next time they apply for a credit card.

• Use a pre-qualification tool to see if there’s a credit card that you’re eligible for. Your credit score takes a hit if there are multiple hard inquiries on your account over a short period of time, so you only want to re-apply for a credit card if you are sure that you are eligible for it. Try our quiz to see which card might be right for you!

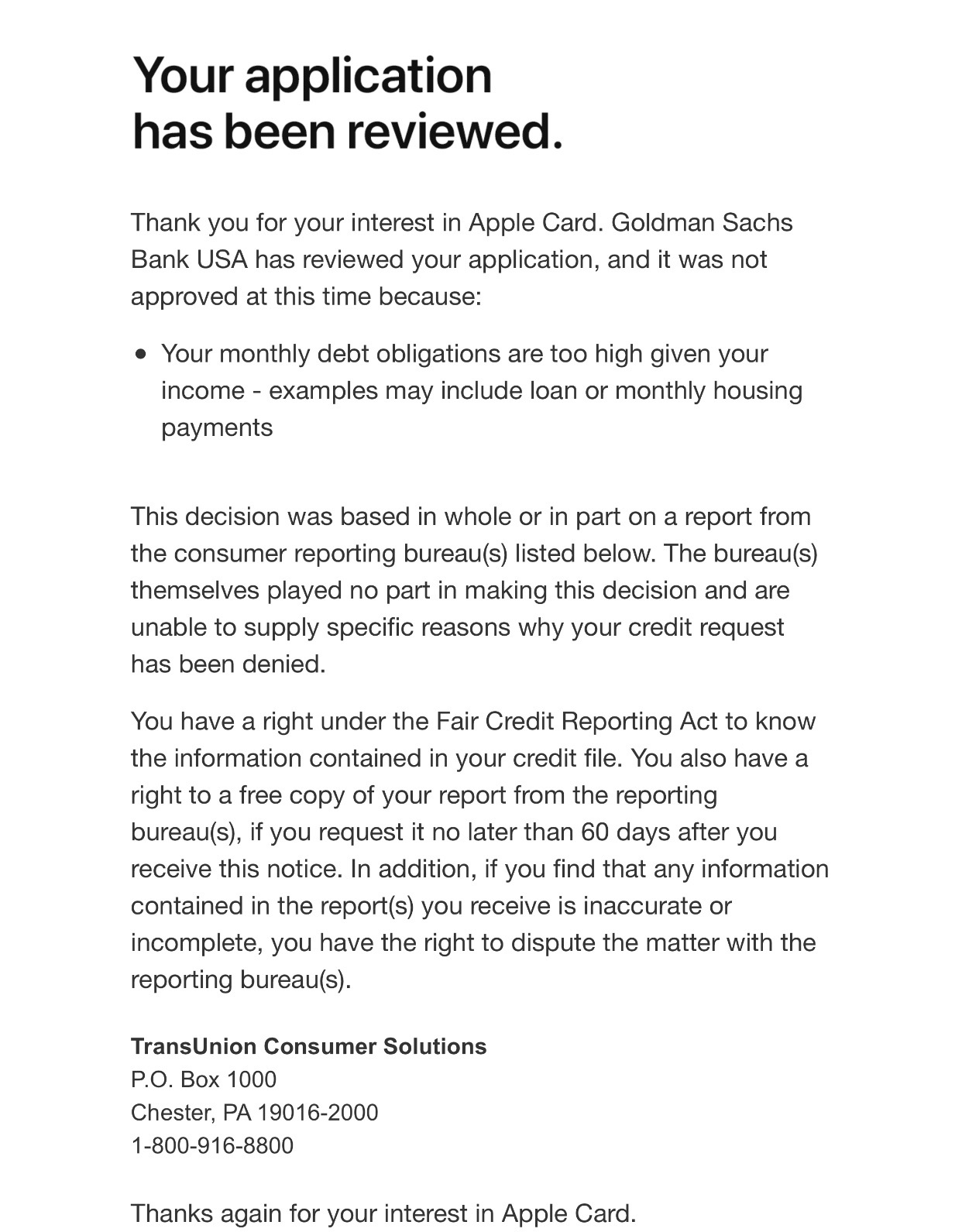

Letter #2: It’s a Debt-to-Income Issue.

What it says: “Your monthly debt obligations are too high given your income — examples may include loan or monthly housing payments.”

What it means: “Your monthly debt obligations are too high given your income” means your debt-to-income ratio is too high. You want to have little debt and a high income when you apply for a credit card, because that gives them assurance that you will be able to pay your credit card off every month. When lenders calculate debt, they look at your rent and/or mortgages, student loan debt, auto loan debt, and minimum monthly credit card payments. They ask themselves: based on your income and how much you already owe your landlords and lenders, are you in a position to take on more debt? Are you living within your means, or are you living beyond your means?

What you can do: Achieving an optimal debt-to-income ratio may be particularly challenging for women: women tend to carry more student debt than men, and their salaries are lower (hello, gender wage gap!). Here are a few ways that you can work toward an optimal debt-to-income ratio.

Take stock of the debt you have and pay off any debt that you can. Pull your own credit report (you can pull them for free once a year at Experian, Transunion, and Equifax) and determine how much you owe on your existing credit cards, mortgage/rent, auto loans, student loans, and personal loans. You can also use a debt-to-income calculator like this one, by Nerdwallet. Are there any debts that you are in a position to pay off right now?

Make sure you are reporting all of your income. When we spoke with women, we learned that many of you have side hustles and alternative sources of income. Make sure that you are reporting all of your income — not just your yearly salary from one job.

Consider calling your bank to switch cards as opposed to applying for a new card. Transferring your credit line as opposed to applying for a new one means that the bank won’t have to issue you more credit. If your bank is offering a cool new credit card that you’re excited about, call them to see if they will switch your current credit line over to the new card rather than applying for a whole new line of credit. Explain to the bank why you’re excited about the new credit card and how you plan to use it. You may need to downgrade your existing credit card to avoid paying two annual fees.

Want to know more? Nerdwallet offers some additional tips here.

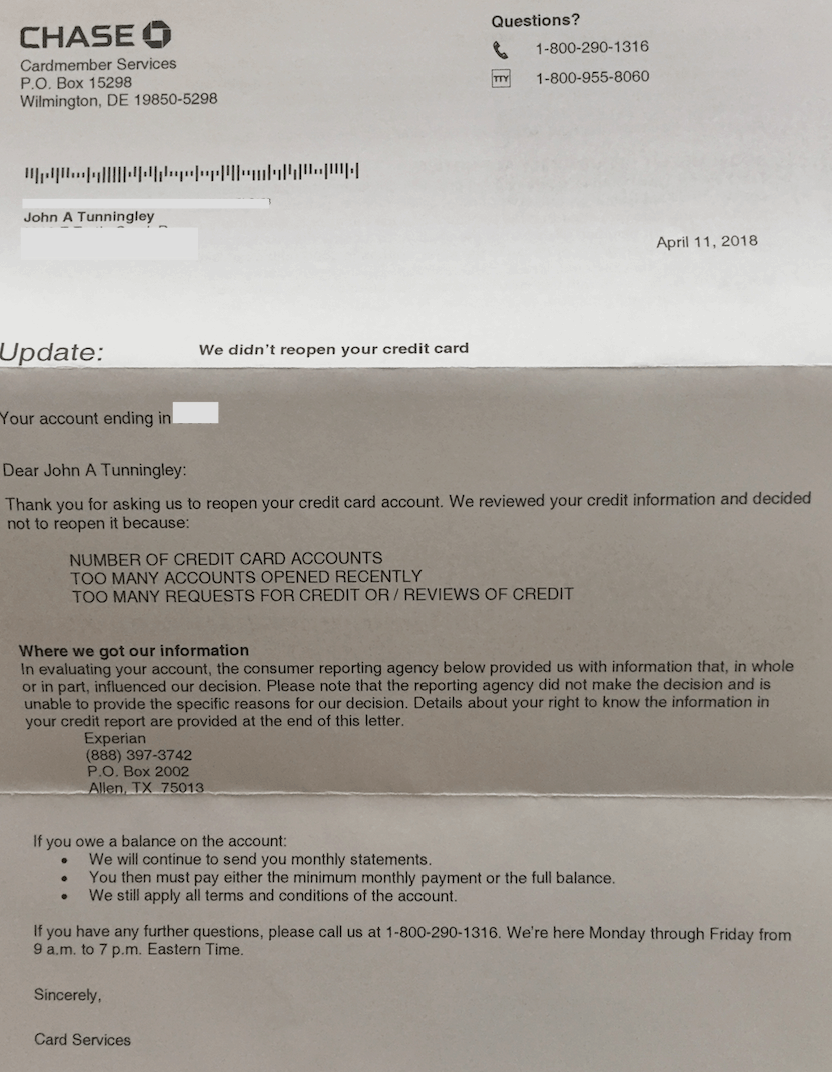

Letter #3: Applying for Credit All Over the Place

What it says: “Number of credit card accounts”, “Too many accounts opened recently”, “Too many requests for credit or / reviews of credit”

What it means: This rejection letter is telling you that there are too many hard inquiries on your account and too many credit card lines currently open. When lenders see that you are searching around for loans, even after you have credit lines open, they wonder if you are in financial trouble. Applying for multiple loans and/or credit cards raises a big red flag and can cause your credit score to take a hit.

What you can do:

Do your research ahead of time before applying again. Before applying for a new line of credit, do your research on how doing so may impact your credit score and consider using a pre-qualification tool (like our quiz to determine what types of credit cards you might be eligible for.

Check your credit score report often. If you’re surprised by the news that you have too many accounts open, double check that there are no fraudulent accounts open in your name. You can do that by pulling your credit report at Equifax, Transunion, or Experian and reviewing it for fraudulent accounts. If you find any accounts on the report that you didn’t open, call right away to report it.

Build your credit score back up. If you are applying for credit often and being rejected, your credit score will undoubtedly take a toll. Make sure to pay your existing credit card balances off on time and wait a little while before applying again.

Disclaimer: A friendly and earnest reminder that content in the Sequin Project is not intended to be financial advice, and that the writers at Sequin are not certified financial advisors. If you’re looking to make any decisions related to the content above, please contact a certified financial advisor first.

Disclaimer:

Opinions expressed here are author's alone, not those of any bank, credit card issuer, airline or hotel chain, and have not been reviewed, approved or otherwise endorsed by any of these entities.